Navigating the Rate Roller Coaster: What’s Behind the Recent Dip and What’s Next?

If you’ve been eyeing the market lately, you might have noticed that mortgage rates recently took a little dip—like catching a cool breeze on a summer day. But what’s behind this sudden shift, and what does it mean for you if you're thinking about buying or selling a home?

The Cause of the Dip: A Blend of Economics and Global Factors

So, why did rates drop? It all comes down to a mix of economic indicators and global events that have the power to nudge the market.

1. Inflation: Inflation has been the main driver of rising interest rates over the past year. However, recent data suggests that inflation is beginning to ease.

Inflation and the Consumer Price Index (CPI): Inflation has moderated slightly in recent months. The annual inflation rate was 3.0% in July 2024, down from 3.3% in June (Duncan Williams Asset Management). While inflation is cooling compared to the highs of 2022 and early 2023, it remains above the Federal Reserve’s target of 2%, which keeps the Fed cautious in its policy decisions (Inflation Calculator).

2. Federal Reserve Policies: Speaking of the Fed, while they’ve been steadily raising rates to combat inflation, they recently signaled a potential slowdown in their rate hikes.

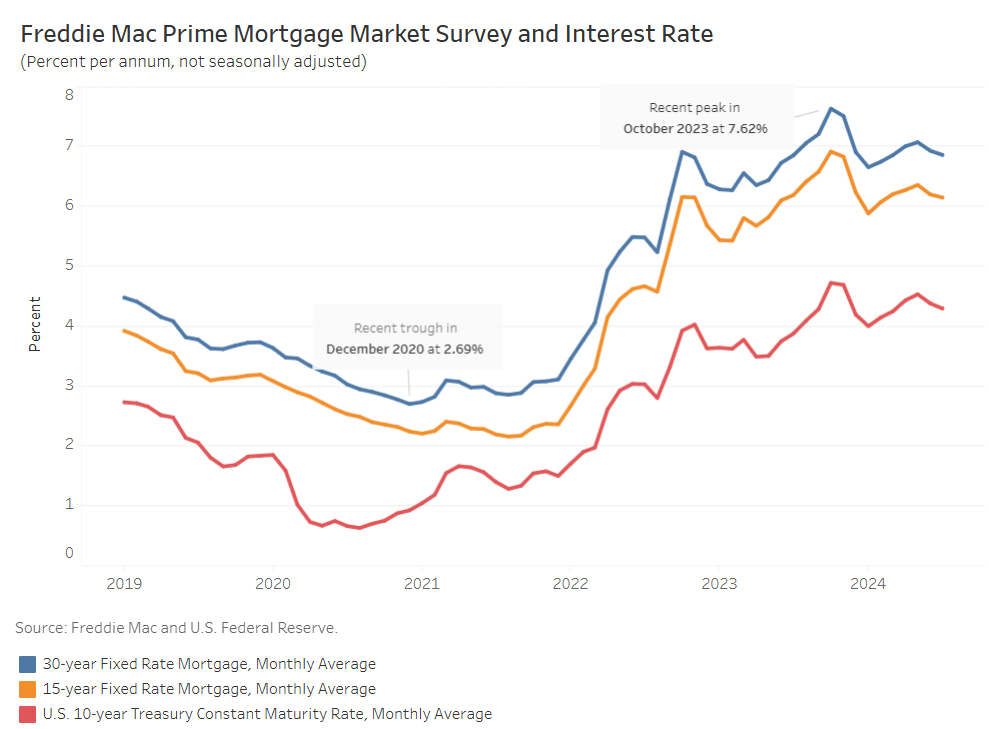

This doesn’t mean they’re done, but it does suggest that they’re more open to observing how the economy responds before making further moves. This more cautious approach has given the bond market some breathing room, leading to a dip in mortgage rates. (Since mortgage rates are closely tied to the yield on 10-year Treasury bonds, any decrease in bond yields can lead to a corresponding drop in mortgage rates.)

3. Jobs Report: The recent jobs report showed that while the labor market remains strong, job growth is beginning to moderate. This moderation could signal that the economy is cooling down, which may reduce inflationary pressures.

A slower-than-expected jobs growth can lead the Federal Reserve to reconsider the pace of its rate hikes, as aggressive hikes could risk tipping the economy into a recession. This balanced outlook has contributed to the drop in mortgage rates (Fox Business) (Money).

4. Global Economic Concerns: Global economic uncertainties, such as fluctuations in the stock market, ongoing geopolitical tensions, and concerns about economic slowdowns in major economies like China and Europe, have also played a role.

What Could Happen Next? The Crystal Ball (Kind Of)

While it’s impossible to predict the future with 100% certainty, a few factors can be looked at that could either keep rates on their current path or send them spiraling in a different direction:

1. Further Decline in Inflation: If inflation continues to cool down, the Fed might take a more dovish stance, which could lead to further drops in mortgage rates. This would be a win-win for potential buyers, as it could make financing a home more affordable.

2. Federal Reserve Actions: On the flip side, if inflation rears its ugly head again or if the job market remains too hot, the Fed might feel the need to raise rates again. This could cause mortgage rates to tick back up.

3. Global Events: The global economy remains a wildcard. Significant developments—good or bad—could sway investor sentiment and, in turn, impact mortgage rates. Keeping an eye on international news isn’t just for political buffs anymore; it’s part of understanding the real estate landscape.

What Does This Mean for You?

As of today (08/08/24), the average rate for a 30-year fixed mortgage is at 6.47%, marking its lowest point since May 2023 (Mortgage Reports). If you're considering buying or selling, this recent rate drop could be a golden window of opportunity.

For Buyers: Lower rates mean lower monthly payments and potentially more buying power. This could allow you to afford a larger home or a more desirable location. It’s also an opportunity to lock in a favorable rate before any potential increases down the line.

For Sellers: A lower mortgage rate can be equally advantageous. With more buyers able to afford homes, your property might attract a larger pool of potential buyers, potentially leading to quicker sales and even multiple offers. This increased demand could drive up the final sale price, giving you more leverage in negotiations.

For those homeowners on the fence about selling and buying, further rate improvements may make a level-up move more palatable.

"Mortgage rates are like a roller coaster—a dip can be exhilarating." - Ann Woudwyk

At WMI Home Team, we’re here to help you navigate these market changes and make informed decisions about your real estate journey. While we keep a close eye on market trends, it’s important to remember that we’re not financial or economic analysts. We always recommend consulting with a financial advisor or mortgage specialist for personalized advice tailored to your specific situation. Chat or Call