Let's get down to brass tacks about something that might sound as fun as organizing your sock drawer but is infinitely more useful when you're saying "adieu" to your beloved home: the net sheet. Amidst the boxes and the bubble wrap, this little gem is going to be your beacon of light, guiding you through the sea of numbers with a latte in one hand and a highlighter in the other.

A net sheet is key to moving forward with clarity and confidence, so any agent worth their salt is preparing net sheets and reviewing them with you.

What's a Net Sheet, Anyway?

Think of a net sheet as the financial 'At-a-Glance' version of the offer. It's a document that breaks down all the moolah coming in and going out when you sell your place. From the big sale price at the top to the nitty-gritty fees and charges, a net sheet gives you the lowdown on what you're really walking away with.

Which is pretty important considering all of the work and memories that have gone into the home, and all of the funds needed from it to move onto the next place to create new memories.

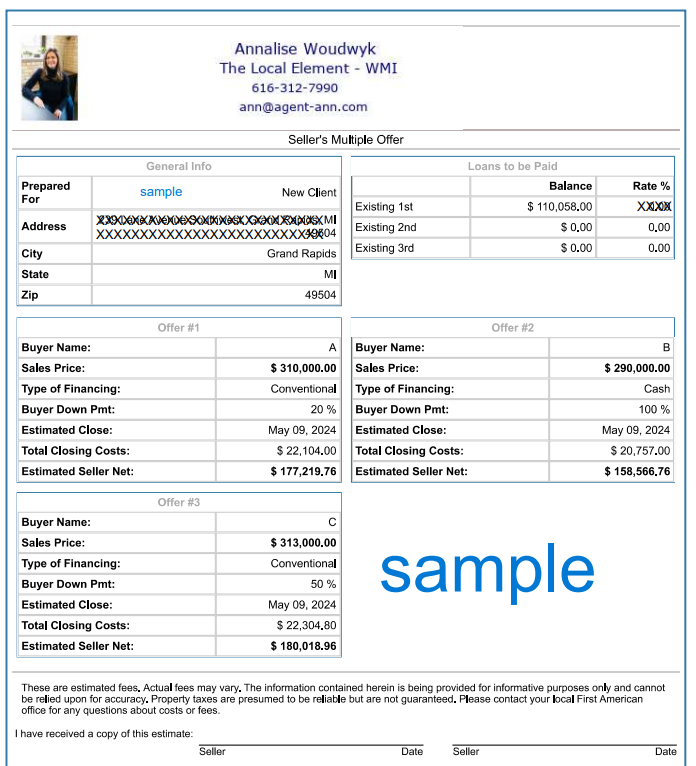

As an offer is received, a net sheet should be prepared to accompany it and to be reviewed together - agent and client. In the event that an offer deadline is set, where multiple offers are received, then the net sheets are put together upon that deadline when all offers are accounted for.

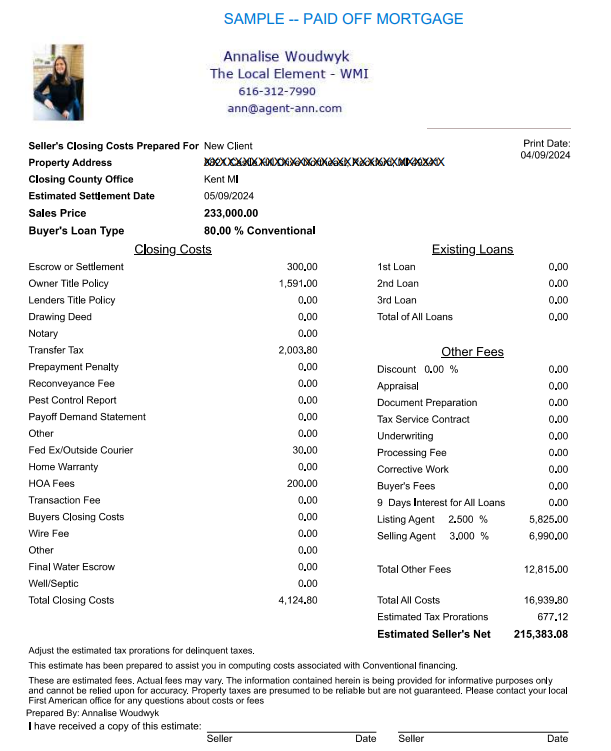

Here's a look of a sample net sheet of a home scenario where the mortgage has already been paid in-full.

What Do Net Sheets Tabulate?

Net sheets can vary in complexity, but they generally include:

- Sale Price: The anticipated selling price of the home.

- Mortgage Payoff: The remaining balance on the seller’s mortgage.

- Agent Commissions: Fees paid to real estate agents, typically a percentage of the sale price.

- Closing Costs: Expenses such as title insurance, transfer taxes, and attorney fees.

- Outstanding Balances: Any liens to be resolved, such as unpaid taxes, utilities, judgments, lines of credit tied to the property.

- Other Expenses: Costs like home warranties, inspection repairs, and any seller concessions to the buyer.

- Credits: Any credits due to the seller, such as prorated HOA fees and property taxes.

What about multiple offers?

What would a multiple offer view look like? Many listings in today's market are receiving multiple offers. Here's a sample view:

What isn't typically shown on a Net Sheet?

Financials are a big part of the picture when selling, but not everything with merit fits neatly into the calculating piece of these forms. Take, for instance, other important terms such as inspection period, appraisal gap coverage, possession after close, and more. Any of those things important to you should be noted so those terms can be weighed as well. Using Net Sheet(s) and notations, your Realtor®

can help you identify the strongest offer and/or any areas where you could negotiate to get the terms needed for an all-around successful sale.

We're curious to know what you'd prefer in a selling situation: Would you prefer to receive and review offers with net sheets in person? Or digitally and by phone?

Whenever there is any way that we can help with your home sale experience, please reach out. 616-312-7990