Homeowner Insurance policy rates are on the rise, and some policies are not being renewed or the insureds are being required to make unexpected improvements/repairs to maintain insurability. Read on to learn what the contributing factors are and what you can do to keep your policy and rates in check.

Have you observed the gradual increase in homeowners' insurance bills? You're definitely not alone in this if you have. Whether it's the soaring property values or troublesome severe weather events, there are various factors contributing to the increased costs of safeguarding your home these days. Let's delve into these escalating expenses and explore some smart strategies to alleviate the impact.

Contributing factors

So, what's the deal with the surge in home insurance premiums? The current market is like a massive rising tide, and you know what a rising tide does – it lifts all boats, whether they're big, small, fancy, or simple; they all go up. That's precisely what we're witnessing with costs across the board, including the cost of insurance. The increased cost isn't just felt by the end-consumer either, it's a passalong from the insurance companies that are paying more out on claims and losing on profits or experiencing actual losses. Based on an analysis of the financial statements of 11 State Farm P&C companies, the group recorded a net underwriting loss of $12.47 billion for the first nine months of 2023.

For homeowners' insurance policies specifically, there is a mix of big-picture factors:

- Mother Nature throwing tantrums more frequently, with hurricanes, floods, tornadoes, and wildfires on the rise, has lead to an uptick in insurance costly claims.

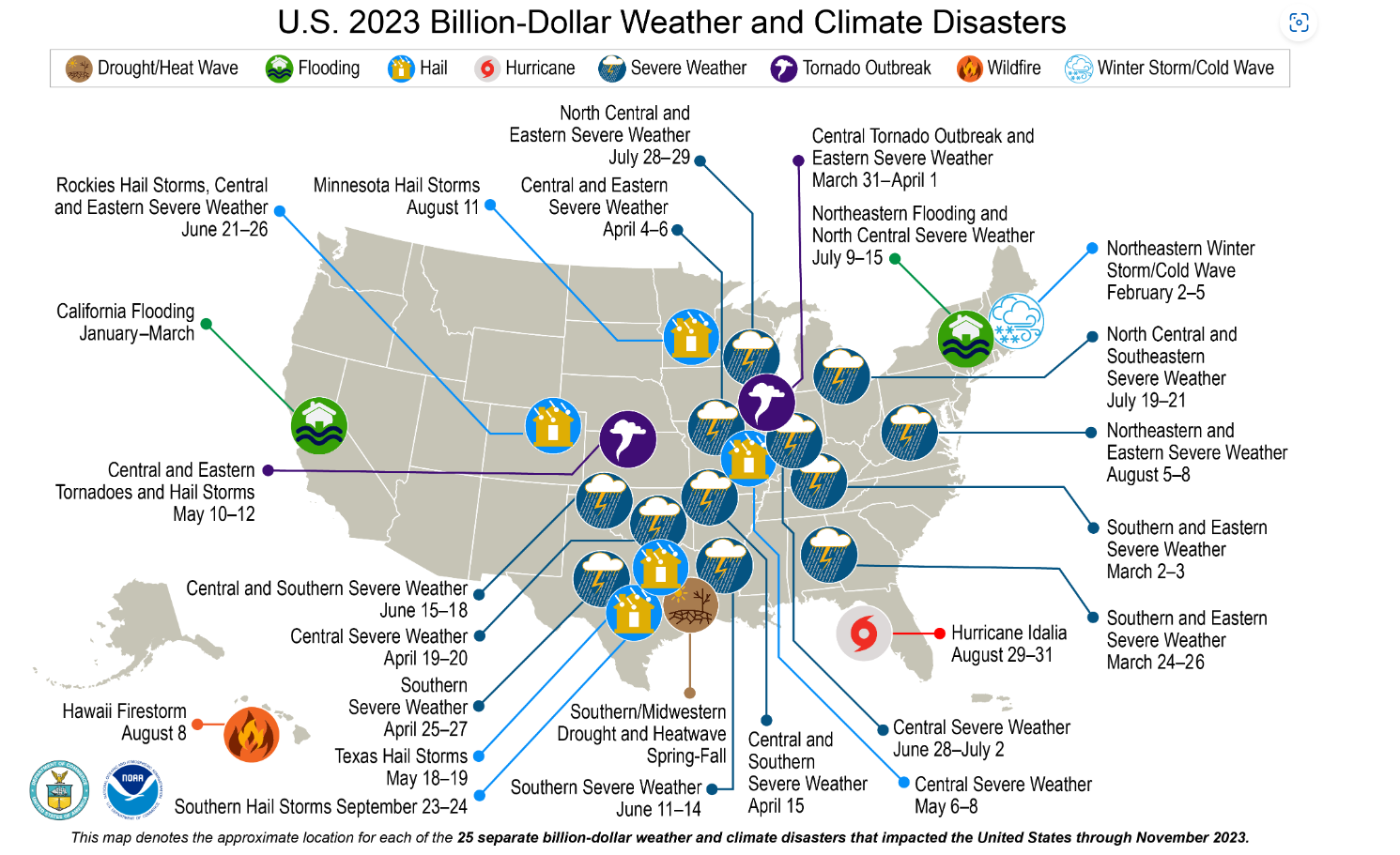

In 2023, the United States experienced 28 separate weather or climate disasters that each resulted in at least $1 billion in damages. NOAA map by NCEI is shown below.

- On top of that, the expenses associated with building a house or doing renovations are through the roof these days. Partly inflation on building supplies, partly labor shortage; either way, many contractors are quoting large sums on claims to insurers for needed repairs. Most claims may be wholly legit but others may be inflated by companies looking to take advantage of down-and-out situations. It's not far from home, so-to-speak, either. In 2022 there was a tornado that caused extensive damage in Gaylord, MI and many companies responded to the emergency. One such company is now being investigated for predatory practices, allegedly overcharging insurances providers and the homeowners for any balance unpaid by the carrier; see what we mean in this 01/05/24 State of Michigan Press Release.

- And let's not overlook the fact that homeowners' insurance companies are becoming more tech-savvy, fine-tuning their rates, especially for those residing in riskier zip codes or older homes. They can hone in on the areas that have the most risk and choose to charge more at renewal, revise what is coverages offered in those areas, or ultimately decide to pull out of those areas altogether and not renew policies.

NOAA map by NCEI

Keeping your home in check

Since insurance companies have seen losses, some are being extra picky on the policies they are keeping at time of renewal. On occasion they may send someone out to photograph the exterior condition of the home and property and make demands based on concerns 'evidenced' in the photos. It may be as simple as requiring the removal of a trampoline in an unfenced backyard where they see liability flags, or it may be a hefty demand like the replacement of a perceived deteriorating roof in order to renew/keep a policy. If they see a threat of the roof not holding up and causing damage to the interior of the home and persons within it, they may decide not to gamble on renewing the policy and give an ultimatum and period of time to remedy or they may drop the policy altogether. Know that this can and does happen. It is important to keep up on the appearance, condition of the home and safety of the property all around for obvious reasons and this one too.

Keeping your policy in check

First and foremost, make sure you have adequate coverage. If you haven't asked for your homeowners' policy to be increased in the past couple of years while home values have seen significant gains and inflation has been at hand, you may be under-insured and unable to fully replace your home if disaster did strike. Once you know your policy is doing its full job of providing protection, see about your deductible options.

Dollar amount deductibles typically range from $500 to $2,500, with $1,000 being a common value. Some policies have more than one deductible, depending on the type of property damage. Separate “wind and hail” deductibles are common, for example — and often higher than the standard deductible. **As a general rule of thumb: the higher the deductible, the lower your premium will be.

In fact, increasing your deductible by just $500 can save you as much as 20% on your annual premium.

Just know the risks that come with this. When you choose a higher deductible, it means you’ll owe more out of pocket should damage occur. If you choose this route, be sure you have plenty in your emergency savings fund, just in case. - The Wall Street Journal

If your home were to sustain significant damage or loss, your claim value would easily exceed your deductible. For example, if you expect repairs to cost $20,000 and your deductible is $2,000, your insurance company covers $18,000 — 90% of the total cost. On the other hand, if you expect repairs to cost $3,000, your insurance company only covers $1,000 — 33% of the total cost. That’s a closer call because filing a claim could result in higher home insurance premiums that eventually offset your payout. You decide on a case-by-case basis bearing in mind this tidbit offered by Bankrate: Claims often have long-term ramifications. In many cases, it leads to a hike in your rate of premium. Sometimes, it may also affect your ability to switch providers and get coverage in the future.

Keeping your prices in check

Most people already know that bundled policies, by buying homeowners, auto, etc. together, most often results in a discount. There's lump sum incentives too; meaning you can see a discount if you pay annually or semi-annually instead of monthly. Besides bundling and lump sum payments, what are other ways to earn discounts?

- Many homes these days already have a security system, whether it's Ring, Nest, Google, ADT, whatever. Make sure your insurance company knows that you have this system, if you do and haven't already filled them in, and see what discount they may provide because it's in place. Security systems act as deterrents so if there's no crime, there's no claim... and they're hoping for both of those things.

- Have you heard of plumbing alert systems? There are systems you can buy online at places like Amazon that can be installed at water sources that monitor for leaks and report when something occurs. Knowing early that there's a problem allows time to respond to the issue before it grows into a larger more costly one; that's the idea behind these systems and why insurance companies can appreciate and incentivize the use of them. See if yours does.

- Increase your credit score. It helps with other insurance policies too, like auto insurance which is already so expensive in Michigan! If you've been monitoring your credit and making strides to improve it for other reasons, remember that it can be beneficial and save you in this area too.

- Shop around & Shop local. Use your current policies so that you are shopping in-kind coverages and see if you can get better rates elsewhere.

|

|

Find the Helpers

Hopefully you are already working with a great insurance agent that looks out for you on the regular - making sure you are adequately insured and are informed of the ways in which your policies can best serve you and how /where you can save money regardless of whether or not a hike is on the horizon.

Online or 1-800 brands rarely bother to know you and your needs well like a local company and may give you what seems like a better rate but not the rundown of the insurers behind the rate and their reps in the biz. You want the whole picture and, in our opinion, that's most easily achieved with working with a reputable, local agent. We are happy to provide referrals upon request.

Whenever there is any way that we can help with your homeownership experience, please reach out. 616-312-7990